2024 Stock Market Performance thru July 12

The US stock market appears to be having a very strong year based on the returns of well-known indices such as the NASDAQ 100 and S&P 500. However, appearances can be misleading. Both indices are heavily concentrated in a small number of mega-cap stocks. The strong returns of those stocks have propelled the indices to gains that exceed those achieved by most individual stocks and well diversified portfolios. Eventually, mega-cap stocks should come back to earth and well diversified portfolios will have an advantage. A key benefit of diversification is to avoid the ups and downs associated with concentration risk and provide a more stable average return.

While the NASDAQ 100 & S&P 500 indices contain many stocks, when calculating index returns the contribution of each stock is weighted by the stock’s market value. The return of a stock with a $10 billion market value has an impact on index return that is 10 times larger than the impact of the same return delivered by a stock with a $1 billion market value. As a result, index returns are heavily influenced by the returns of a small group of mega-cap stocks with valuations exceeding $1 trillion. For example, the semi-conductor manufacturer Nvidia. It started the year with a market capitalization of more than $1 trillion and as of July 12 had gained 168% in 2024. Very few stocks have done as well as Nvidia. Its performance is NOT representative. However, its return has more impact on the return of the index than the combined impact of the returns of 100 companies that have market values of $10 billion or less.

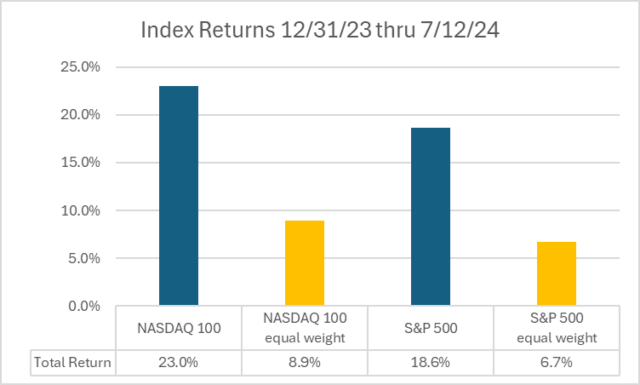

One way to factor out the impact of mega-cap stocks and gain a better understanding of the broad market’s behavior is to recalculate the returns of the indices with each stock contributing equally. As shown in the table below, the 2024 returns of both indices are reduced substantially when stocks are equally weighted.

The difference in return between an index and its equally-weighted counterpart is the short run return due to concentration risk. Thus far in 2024, concentration risk has boosted the returns of both the NASDAQ 100 and S&P 500 by more than 10%. Long run, there is no reason to expect mega cap stocks to outperform. They should “revert to the mean” and provide well diversified portfolios an advantage. Indeed, a key benefit of diversification is to avoid the ups and downs associated with concentration risk and provide a more stable average return.

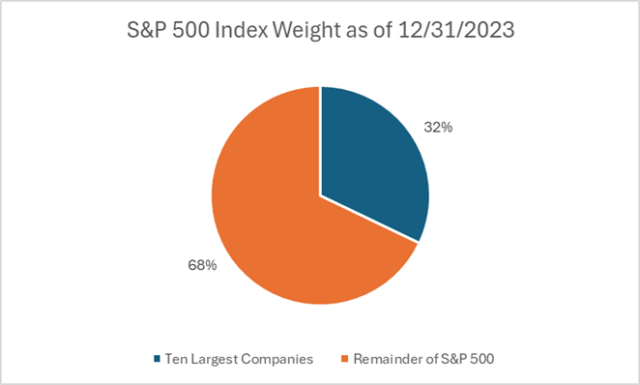

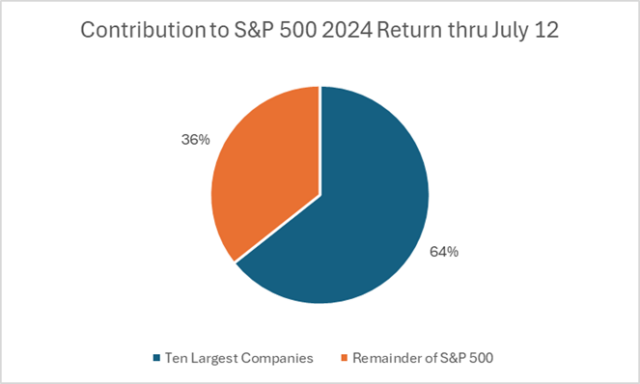

The Importance of the Ten Largest Companies* Within the S&P 500

Although the S&P 500 Index contains stocks of 500 companies, those companies do not contribute equally to the index or the return of the index. The index weight of each company is based on the value of its stock. As shown in the charts below, the ten largest companies in the S&P 500 represented 32% of the index at the end of 2023 and have provided 64% of the S&P 500’s 2024 return through July 12th of this year.

* Based on holdings listed in the Vanguard S&P 500 Index Mutual Fund Annual Report dated 12/31/2023. The companies, ranked from largest to smallest, were Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, Tesla, Berkshire Hathaway, JP Morgan Chase, and Broadcomm.

How is the 2024 “Bull” Market Affecting You?

If your investments are consolidated at Arbor, you may have earned returns more comparable to the equally weighted index fund bar graph explained earlier, if you have a 100% stock allocation. As a client of Arbor, we tailor your investment portfolio based on how you answer the question “What do you need to earn on your investments to live the life you want for the rest of your life.” Your stock-bond allocation and risk tolerance need to match to achieve that objective. Our investment philosophy not only focuses on risk management through investment allocation, but also through diversification of the stock portfolio and weight balances that reduce risk even further and minimize the downs when they occur. As a result, the short-term returns during periods like what we are seeing now may be less dramatic. However, when we look at the long-term performance the results are often quite similar, potentially even leaning more favorably towards the equally weighted, diversified portfolio. Furthermore, you will find when you start drawing down on investments you do not have control of whether the market is up or down. The majority of us will say the perk to retirement is less stress than when we were in the workforce, but is that still true if your retirement is in the S&P when a bear market hits and you potentially lose 20-30% of it right when you start drawing down on it? The moral of the story is that no one can 100% predict the market; Arbor’s conservative risk-controlled approach takes that fact and optimizes it into personalized risk/reward profiles for our clients. If you have any questions or would like to better understand the exact effects this market has had on your accounts, reach out to set an appointment with our team today.

This report has been generated from information that Arbor Financial believes to be reliable and accurate. We do not represent or warrant the accuracy or completeness of the information contained in this report. As such, all calculations, estimates and opinions included in this report constitute our best judgment as of this date and may be subject to change.

Past performance is not a guarantee of future results. In fact, several studies suggest there is little or no correlation between past performance of specific investments and their future results.

Peter has more than 25 years of experience in the financial industry as a researcher, strategist, and portfolio manager. As a portfolio manager at Arbor, Peter performs quantitative analysis on current and prospective portfolios.

Peter is a CFA charter holder. He earned his PhD in Economics as well as dual Bachelors of Science degrees in Computer Science and Pure Mathematics from the University of California, Santa Barbara.

Before joining Arbor, Peter was a Founding Member of institutional money manager OakBrook Investments and worked there for 22 years serving in a variety of roles including portfolio manager, Director of Research, and co-Chief Investment Officer. Prior to forming OakBrook, Peter worked at ANB Investment Management & Trust Company as a strategist, portfolio manager, and Head of Research.

Peter has lived in Lisle, Illinois since 1997. Outside of work he enjoys sports car racing and is an active member of the Autobahn Country Club in Joliet, Illinois and the Sports Car Club America (SCCA).