The millennial generation – or today’s 30- and 40-year-olds – are facing a financial crisis. From the Great Recession to the COVID-19 pandemic, they’ve faced plenty of financial tumult – and it shows. When it comes to accumulating wealth, millennials are trailing 10 times behind their parents’ generation. And that wealth gap becomes a big problem when considering retirement.

Retirement anxiety isn’t reserved for millennials: Researchers estimate that half of all U.S. households aren’t ready to maintain their standard of living in retirement, even if they work until age 65. But with more student debt and less in savings than previous generations, many millennials are uniquely unprepared for retirement, set up to face an even more difficult and less comfortable retirement period.

This is the final installment of Arbor’s Generational Wealth Series, in which our trusted advisors prepare you for some of the most important financial moments in life. We’ve covered student debt, homeownership, starting a family, and elder care. Now, our last blog will review one of the most discussed, but most difficult, financial milestones: Retirement.

Retirement

Many Americans struggle to adequately prepare for retirement – it’s one of the greatest financial costs many of us will face in our lives. But with many other compounding financial barriers, millennials find themselves in a uniquely difficult spot.

For one, the average millennial has much less in savings than their parents’ generation. The COVID-19 pandemic only exacerbated that trend: over 15% of millennials even took an early withdrawal on their 401(k) plans during 2020, setting them further back in retirement savings. So it’s no surprise that 72% of millennials are worried about achieving a financially secure retirement. In fact, many worry they won’t truly retire at all: 61% report they’re planning to work a second job during retirement.

The truth is clear: The odds are stacked against this generation. But with sound financial planning and a trusted advisor on your side, you can beat the odds and live the life you want to live – even into retirement.

Compound Interest or Compound Cost?

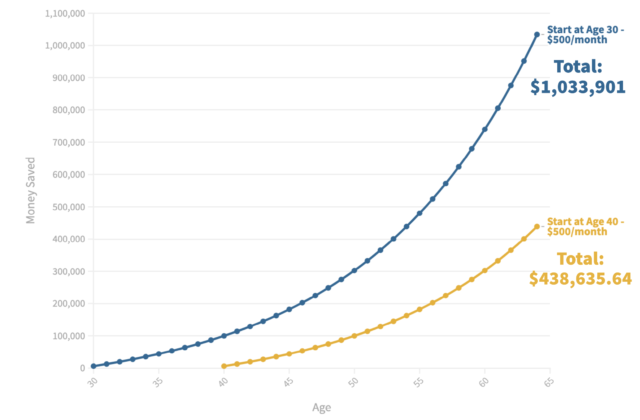

Most people are familiar with the concept of compound interest: Given just a small investment and the power of time, your money can grow robustly. But have you heard about the risks of compound cost? Every day you wait to save for retirement is a day more expensive. In other words, the longer you wait, the more you’ll have to contribute to your retirement fund when you do start – because your money hasn’t been growing for you.

Take this example: If you begin saving $500/month towards retirement when you’re 30, assuming an 8% average annual return, you’ll have over a million dollars in retirement savings by 65. But if you wait to start saving until you’re 40, you’ll accumulate less than half of that by age 65. You’d have to contribute nearly $1,200/month to make up for the lost ten years – that’s $700 more each month than the 30-year-old who started early.

The risks of starting too late are real. But there are ways to avoid the hazards of compound cost and capitalize on the opportunities of compound interest to enjoy the retirement you deserve

Finding a Trusted Financial Advisor

Many people believe saving for retirement is just about maximizing their employer-matched 401(k) benefits. But saving for retirement has become more complicated than that – and it’s essential to have a professional opinion before you start.

An experienced Financial Advisor will evaluate your individual situation and determine what you need for a comfortable retirement, from healthcare costs to second homes. Then, they’ll form a plan to help you get there. At Arbor Financial Services, our experienced advisors conduct “How Long?” profiles for our clients to determine how long their money will last in retirement. We consider both individual factors and market trends to determine exactly the right investment strategy for you, so you can live the life you want.

To learn more about the traits of a strong Financial Advisor, see here. To schedule an appointment with Arbor’s professional advisors, click here.